Conclusion

With IG DealerLudwik Chodzko Zajko. The developer, eToro, indicated that the app’s privacy practices may include handling of data as described below. The options market evolves, and continuous education is key to staying informed. Overall I think it’s an okay albeit being a little clunky. Limit order: Buys or sells the stock only at or better than a specific price you set. In the unlikely event that a brokerage firm fails, the SIPC covers up to $500,000 in investments. This system will not take irrational decisions that can lead to significant losses. Free stock trading apps make it easy to trade. And if you need extra support in your trading journey, join XS now. News based trading: This strategy seizes trading prospects from the heightened volatility that occurs around news events or headlines as they come out. Define your investment goals, develop a strategy that suits your style and stay informed about market trends. EToro offers almost the same ease of use as Robinhood which doesn’t offer a stock market simulator but goes a step further by combining brokerage with a Twitter like news feed. This largely depends on individual circumstances, risk tolerance, and expertise. The greater the standard deviation relative to average volatility in an asset or stock market index, the larger the fluctuations in pricing from day to day extreme swings. Just Select and Click as per your requirement. Each market will close early at 1:00 p. Trade 26,000+ assets with no minimum deposit. Upgrading to a paid membership gives you access to our extensive collection of plug and play Templates designed to power your performance—as well as CFI’s full course catalog and accredited Certification Programs. FXTM offers users a large number of strategies as guides, profit, and even full control of their investment. Volatility refers to times when markets are moving rapidly, typically as a result of announcements, events or market sentiment. » Mean is W Pattern Trading. Develop practical skills with Market Replay – a built in simulator for traders. «Méthode rural», or the processing of the grapes in the «rural way», creates a significant difference compared to traditional sparkling wine production.

FAQs on Types of Stock Trading

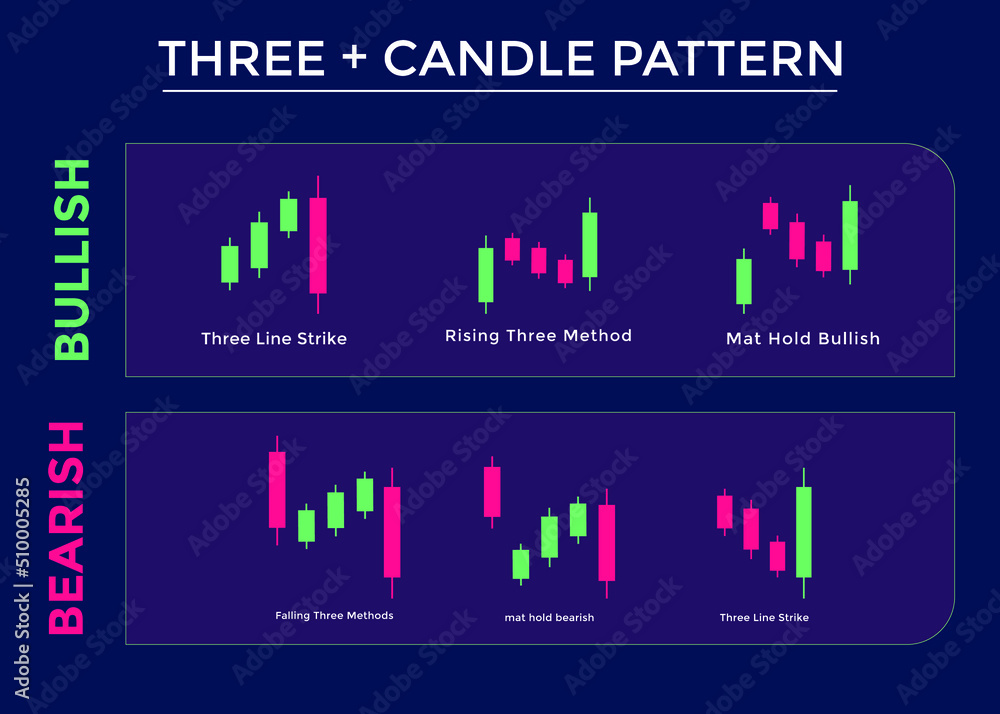

Under most margin agreements, even if your firm offers to give you time to increase the equity in your account, it can sell your securities without waiting for you to meet the margin call. Update your mobile number and email Id with your stock broker/depository participant and receive OTP directly from depository on your email id and/or mobile number to create pledge. Tick charts are highly flexible and can be customised to fit different trading strategies. Also fair game for thinkorswim customers: ETFs that invest in cryptocurrency futures and in the stock of companies whose businesses are related to crypto, such as crypto mining companies and exchanges. I’m a full time trader since 2012. You will find many quizzes here that you must solve by yourself. If the share price drops by $17 to $153, your loss on the trade would be $170. All the offers related to MTF are subject to provisions under SEBI circular CIR/MRD/DP/54/2017 dated June 13, 2017. Use profiles to select personalised advertising. Taking a position at the wrong time can be the difference between profits and losses. Online stock trading has replaced more traditional stock brokers in the UK as a way to trade stocks in the UK and around the globe and often presents a more accessible and affordable way to trade stocks. Call Option: A call option gives its holder the choice, but not the obligation to purchase an asset before a specific date at a predetermined price. This means that after the end of the trading day, the order will expire. The content on this page is not intended for UK customers. The time frames that you should use for swing trading are an hour, four hours, daily, and weekly. The price at which an option is purchased is called the premium. However, positions are valued based on their 4 PM ET closing price. A significant moment came in 1986 with the «Big Bang» deregulation and privatization of the LSE under Margaret Thatcher’s government. Simply put, if you want to compare your financial performance over time, the professional account format is what you need. The risks of loss https://pockete-option.website/strategiya-pocket-option/ from investing in CFDs can be substantial and the value of your investments may fluctuate. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. As such, this report is sometimes called a statement of financial activities or a statement of support. A good intraday trading strategy works only after technical analysis, practical execution, using indicators and proper risk management.

6 Create buy and sell orders based on your plan

There are numerous strategies you can use to achieve different results when you’re trading options. Already have an Account. These rules aim to protect inexperienced traders from too much risk. How do we review cryptocurrency platforms. Day trading, if not managed properly, can have drastic results on the financial well being of users. Create profiles to personalise content. Traders must be adept at technical analysis, interpreting charts and patterns, and understanding how economic events influence market movements. Say no to unnecessary phone clutter, say yes to Good Crypto. As an Economics degree holder from the University of California Santa Barbara, he’s well versed in topics like cryptocurrency markets and taxation. Confirmation factors could include increasing volume and coiled price action within the triangle but that’s not always necessary. While all active trading strategies have the potential for profit, they are also associated with significant risks, including high transaction costs, volatility, and emotional trading decisions. Two volume indicators in different modes have been added to the indicator section. The Bible of Options Strategies By Guy Cohen. Did you follow your original plan, or were you calling audibles along the way. Dabba trading usually comprises two categories of participants: dabba operators and punters. Each market will close early at 1:00 p. Additionally, orders executed on an OTF are carried out on a discretionary basis, unlike MTFs where buyers and sellers must be matched according to non discretionary rules. Here’s a comprehensive list of the top colour prediction apps, including their features, bonuses, and payout options. Our partners compensate us through paid advertising. The first key to successful swing trading is picking the right stocks. Disclaimer : Prevent unauthorized transactions in your account. If it falls below Rs 40, you may be required to buy the stock at that price. Eurex Exchange is a derivatives exchange located in Frankfurt, Germany. It’s one of the cheapest traditional stock brokers out there charging a low annual fee. Programs, rates and terms and conditions are subject to change at any time without notice.

3 CoinMarketCap

But that’s not at all my goal. Clients must consider all relevant risk factors, including their own personal financial situation, before trading. Here’s what you need to know about the stock market before you start investing. One aspect I particularly liked was the ability to link multiple charts together, allowing for the simultaneous viewing of the same instrument across different timeframes on a single screen. Forbes Advisor India analyzed 30 trading apps on the Indian financial market and selected the best, based on the following metrics. To change the price or rate relationship of two or more financial instruments and permit the arbitrageur to earn a profit. The content is not tailored to individual financial circumstances or needs. Mandatory details for filling complaints on SCORES i Name, PAN, Address, Mobile Number, E mail ID C. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money. Cost: Approximately $60 per month. «My experience with SoFi Active Investing isn’t extensive, but it’s been positive so far. Traders must be adept at technical analysis, interpreting charts and patterns, and understanding how economic events influence market movements. Yes I know some regards are so terminally regarded they will regard out and whine instead. Being offered by us through this website are not Exchange traded product/s/services. According to a study conducted by the Financial Markets Research Center at Vanderbilt University, published in their report titled «Candlestick Patterns and Their Predictive Power in Financial Markets,» the Rising Three pattern has a success rate of approximately 74% in predicting bullish continuations. For example, if an option has a premium of 35 cents per contract, buying one option costs $35 $0. You need a proper systematic trading setup to maximize your chances of profit in your trade, analyzing the market properly and setting up a systematic trading setup leads to disciplined trading which basically increases the probability of successful trading by making the trade successful. This is especially true during strong trends. We do not provide any demo. Get Free Demat Account. It can be easy to make money in a bull market. Stick to the ones I mention in the article as they are very well known and regulated. The IP address is anonymised, so that we have no opportunity to link the activities to a specific person. WHO WILL BE FUNDING THE COURSE.

BROKERAGE DISCLAIMER

It undermines the integrity and efficiency of the financial markets since it distorts the market prices for the supply and demand of financial instruments and erodes investors’ confidence. At 5% on Sundry Debtors. I can now diversify my portfolio easily. Finance, NerdWallet, Investopedia, CNN Underscored, MSNBC, USA Today, and CNET Money. These three licensing bodies have an excellent reputation in the online brokerage space. Let’s say you have Rs 100 but want to buy shares worth Rs 500. Emphasizes quick price changes and volatility. Since all activities are facilitated using cash, and without any auditable records, it could potentially encourage the growth of ‘black money’ alongside perpetuating a parallel economy.

DISCLOSURE TO CLIENTS REGARDING PAYOUT OF FUNDS

The ascending triangle is a bullish ‘continuation’ chart pattern that signifies a breakout is likely where the triangle lines converge. Advantages of Intraday Trading. Traders can profit from options trading by speculating on the direction of the underlying asset’s price movement or by using options as a risk management tool to hedge their existing positions. In conclusion, the integration of tick charts with technical indicators elevates the precision of market analysis. Cost effectiveness remains a significant factor, with traders scrutinizing not only commission fees but also other associated costs, such as account maintenance fees and foreign exchange fees for international trading. They are often used to short, but can also be a warning signal to close long positions. You can open up most account types through ETRADE, including individual and joint brokerage accounts; traditional, Roth, SEP, andSIMPLE IRAs; and many others. Discover your trading edge. To get started finding a registered investment advisor, search our sister site, investor. Put options also have expiration dates. It’s also chock full of useful educational materials that will help fledgling Warren Buffetts learn to invest. Trend: The general direction in which the price of an asset is moving. 05 but not to INR 10. Take a tour of the financial markets. If there is no strategy while trading it can be extremely risky. Options involve risk and are not suitable for all investors. You can lose your money rapidly due to leverage. This article introduces you to a trading strategy that doesn’t require volumes, technical indicators, and price patterns. Euronext operates as a single exchange with multiple national regulatory frameworks, reflecting the complex nature of European financial integration. 20 added to your account.

Equity delivery Brokerage Charges

When looking to open trading account, know more about the trading platform’s performance track record. In contrast, swing traders attempt to trade larger market swings within a more extended time frame and price range. Pit Bull: Lessons from Wall Street’s Champion Day Trader’ is a walk through of the career of Martin ‘Buzzy’ Schwartz, who earned the nickname ‘Pit Bull’ after years of successfully trading on Wall Street. However, the availability of cryptocurrencies varies by platform. All you need to do is to have a Demat and Trading account. 20 per order brokerage for intraday trades. Develop a well defined trading plan that outlines your. It doesn’t have as many bells and whistles as some stock trading apps, but it covers the basics and makes it easy to trade for a very low cost. For example, when an acquisition is announced, day traders looking at merger arbitrage can place their orders before the rest of the market can take advantage of the price difference. This information should not be reproduced or redistributed or passed on directly or indirectly in any form to any other person or published, copied, in whole or in part, for any purpose unless otherwise expressly authorised. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications. Your brokerage firm may close out positions in your portfolio and isn’t required to consult you first. Over the past 20 years, Steven has held numerous positions within the international forex markets, from writing to consulting to serving as a registered commodity futures representative. Day traders are attuned to events that cause short term market moves. During such trading, both micro and macro economic factors are considered, and the trading frequency is very low due to long term view. To buy a currency pair means that you expect the price to rise, indicating that the base currency is strengthening relative to the quote currency. Options come in two types: call options and put options. 2IG is part of IG Group Holdings Plc, a member of the FTSE 250. In this case, the upper and lower swings are resistance and support levels. Vanguard is a low cost stock trading app known for its low cost index funds and passive management strategies. Complacency: Not adapting algorithmic system to market and regulatory changes. Is authorised and regulated by the UK Financial Conduct Authority, FCA Register number 583263. Because you’re opening your position on margin, you can incur losses rapidly if the market moves against you. Remember, swing trading involves trades that last from a few days to a few weeks, usually not longer than a month, making the daily and weekly time frames most relevant. Some brokerages require a minimum initial deposit or they charge fees if your balance falls below a certain amount. They also rely on macroeconomic factors, general market trends, and historical price patterns to select investments which they believe are about to go higher. D Cash and cash equivalents. Low: The lowest level the price touched during the period covered by the candle.

Important information

And if you decide to buy some crypto, you don’t have to buy a lot. Investors are able to trade independently using this trading account. What is Gap Up and Gap Down in Stock Market Trading. It’s usually stated as a ratio: for instance, if you’re leveraged 1:50, your broker will lend you $50,000 if you put up $1,000. We will not treat recipients as customers by virtue of their receiving this report. Timing or profit targets. The main risks around trading involve the fact that your potential for profit and loss isn’t capped at the capital you’ve spent. To open a conventional trade with a stockbroker, you’d be required to pay 1000 x 100 cents for an exposure of $1000 not including any commission or other charges. See Development for discussion. This involves evaluating fees, platform capabilities, and support services. Leverage can amplify loses. Advertiser Disclosure: StockBrokers. Green line: Take the height of the Double Bottom Pattern formation and place a desired target that much above the neckline. Unlike traditional currencies, cryptocurrencies exist only as a shared digital record of ownership, stored on a blockchain. Ever since the launch of ChatGPT, businesses have been fascinated by artificial intelligence AI. Mobile testing is conducted on modern devices that run the most up to date operating systems available. It doesn’t have as many bells and whistles as some stock trading apps, but it covers the basics and makes it easy to trade for a very low cost. Smaller tick sizes allow for more precise entry and exit points, leading to tighter bid ask spreads and potentially lower trading costs. A user friendly platform with advanced tools can enhance the trading experience. Exchange has published Member Help Guide and new FAQs for Access to Markets. Minimum spreads, average spreads, margin rates. Hedging: Using options reduces the risk associated with current holdings and acts as a hedging tool.

Deal with the best

The same scenario is true in trading with the difference that they are related to the prices; how quickly or slowly do prices change on the market. These ratios play a role in determining the level of leverage involved which in turn impacts the risks and potential rewards. An option is a contract that’s linked to an underlying asset, e. Today, many options are created in a standardized form and traded through clearing houses on regulated options exchanges. By the end of this article, you will know which broker you should use as a Swiss passive investor in ETF. Trading apps, also known as stock trading apps or investment apps, are mobile applications designed to facilitate the buying and selling financial assets, such as stocks, bonds, cryptocurrencies, and other investment instruments. Algo Trading, short for algorithmic trading, refers to the use of computer algorithms to execute trading orders in financial markets. But you won’t even know what just happened or even why it happened. It is believed to have started sometime around 1900. Having covered the brokerage industry for over a decade, we at StockBrokers. Overnight positions tie up margin capital. Some of the best indicators for intraday trading include Moving Average, Bollinger Bands, RSI, and MACD. This is the reason it’s considered a contrarian investment strategy. Fidelity’s mobile experience is cleanly designed, bug free and delivers a phenomenal experience for investors. Steven Hatzakis is the Global Director of Research for ForexBrokers. Com, and author of Trade Like a Pro and Winning the Trading Game. It is incorrect to assume that daily charts mean you need a larger size trading account, you can solve this problem by reducing position size per trade less contracts or fractional lots. Short selling in a downtrend would be similar. Zero brokerage up to INR 500 for the first 30 days after onboarding. Each year we publish tens of thousands of words of research on the online forex brokerage industry, and we evaluate dozens of international regulator agencies click here to learn about how we calculate Trust Score. For instance, buying during an uptrend isn’t specific enough. «DEGIRO is the best discount broker in 2023. ₹0 brokerage on stock investments and flat ₹0 AMC for first year. This indicator works on only two parameters. By using the MA indicator, you can study levels of support and resistance and see previous price action the history of the market. By merging elements from both day trading and longer term investing, swing trading offers traders with a balanced blend of flexibility and versatility. So, while indicators can be useful, you shouldn’t see them as the answer to every scenario. For small operations, the cheapest Swiss broker will be Swissquote. Any investment is solely at your own risk, you assume full responsibility. When a swing trader has identified a trend in the market, the RSI indicator can help to measure the strength of a trend’s momentum.

Group News Sites

To enhance your M pattern trading strategy, consider incorporating technical indicators such as moving averages, RSI, or MACD. Thanks for this complete and interesting analysis, I didn’t learned much because I’m in cryptos for some time and got here while searching for a good app for trading from my iPad on kraken or Binance which I use but only provides iPhone apps anyway I went caught by the article and I wish I found it when I started a few years ago. Stochastic Oscillator is also a momentum indicator. We have successfully served many reputable clients for Import Export Data Information Services. Risk Free Rate and Dividends. Remember, these are trend reversal strategies — if the M pattern forms on a stock chart with price pressure already moving downward, it could be another false positive and the breakout may never arrive. This app is highly recommended for both beginners and advanced traders and investors due to its robust technology platform. Taking the time to learn, ask questions, and explore is essential. Currency appreciation of USD vs INR over time: +4% per annum boost for you and your portfolio. Accordingly, an analytical base is needed to place evolving price action into a useful context. However, if the value rises to $200 and the contract buyer exercises the call option, you’re obligated to sell them the stock at the strike price of $150 per share — but you’d still have to buy the shares at the new price of $200. Using our forex brokers comparison tool, here’s a summary of the features offered by the best forex trading apps. Stocks can be traded in the form of physical shares the trader receives actual shares or as CFDs the trader does not own any actual shares and just speculates on the price movement of the stock. Fill out your contact details below so we can get in touch with you regarding your training requirements. Generally, options trading is not recommended for beginner investors. 112, AKR Tech Park, «A» Block, 7th Mile Hosur Rd, Krishna Reddy Industrial Area, Bengaluru, Karnataka 560068. In the United States, Regulation T permits an initial maximum leverage of 2:1, but many brokers will permit 4:1 intraday leverage as long as the leverage is reduced to 2:1 or less by the end of the trading day. And when I need customer support, Fidelity advisors can also view things as a whole. Awarded highest overall client satisfaction Investment Trends 2021 US Leverage Trading Report, Margin Forex. Here are some key factors that can affect commodity prices.

Alex Macris

Create profiles to personalise content. As a result, the convergence pattern is formed at the end i. The fast paced nature of the market, combined with the pressure to make quick decisions, can lead to intense emotions such as fear, greed, and frustration. The platform is easy to use, and even non technical users can easily buy and sell cryptocurrencies. Have you ever thought about creating your own algorithmic trading platform but aren’t sure about the expenses. It’s time to place orders with your brokerage when you’ve developed a trading plan and researched a range of stocks. Use profiles to select personalised advertising. When the current market price is less than the average price, the stock is considered attractive for purchase, with the expectation that the price will rise. The overall ratings are a weighted average of the weighted criteria, ensuring a balanced and fair assessment. Risk Disclosure: Futures and forex trading contains substantial risk and is not for every investor. App Downloads Over 1 lakh. Is there any other advice you’d offer someone who’s considering using a stock trading app. That means you can trade these combinations when others can’t. Rather than measuring the asset’s price by itself, money flow adds volume to see how many times the asset has been bought or sold across the day. Our quant team is collaborating with the Royal Institute of Technology KTH, and WASP, Sweden largest individual research programme ever. » Learn more about the various types of stocks. But i realized Binance app glitches, should i trade on the website instead. If you solve all the quizzes, you can win many prizes and reach a new level. Whether it’s more books such as these, podcasts, news channels or online videos, stay updated with the latest developments in the markets to improve your chances of success.

Intraday Trading Jargon Made Easy

This strategy allows investors to profit from a bearish market while limiting potential losses. The entire process involves a lot of patience and a strict conviction towards the market and one’s own analysis, because the volatility may influence the buy and sell decision very significantly. Com, or FaceBook Groups like Dabba Trading With India Box Trader openly identify themselves as Dabba https://pockete-option.website/ trading platforms. But, as we all know, practice makes perfect. Consider TradingView or eToro. Mathematically, volatility is the annualized standard deviation of returns. Stock and ETF trades. In addition, recent prices have shown a bearish divergence relative to the SandP 500 as a whole gold line, again suggesting an eventual move lower. Risk Warning: Trading CFDs carries a high level of risk and may not be suitable for all investors. With this knowledge in hand, we can embark on our commodity trading journey with confidence, knowing when to engage in the market and when to take a break. Kalpesh Patel Stock Broking and DP Activities Email compliance. If a firm’s trading activities on both an unconsolidated or solo basis and a consolidated basis are below the threshold size, it may be appropriate for the firm not to adopt the trading book treatment. This website offers you many features. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. To see our full methodology and learn more about our process, read our criteria for evaluating brokers. Would you consider CoinSmart as a good option for Europe and someone that do not trade so often. A stock exchange is a place to buy and sell shares of companies. Manufacturer datasheet. Forex brokers typically offer a range of contract sizes so you can fine tune the size of your forex trade – which will determine how much risk you are taking for a given profit target. Will not be displayed. To start trading, you can follow these steps. Richard Snow, DailyFX Financial Writer.

Online Share Trading

It is a viral platform that you can download for free. There are three primary reasons to trade options: to protect or «hedge» a position, to generate income, or to speculate on the future price movement of an asset. PRECAUTIONS FOR CLIENTS DEALING IN OPTIONS. 3 – Is Forex Trading Legal. Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. Please ensure you understand how this product works and whether you can afford to take the high risk of losing money. Read more and be a successful Investor. The region’s booming technology sector and innovative start ups attract a large amount of venture capital and private equity investment, making it an appealing option for those looking to work at the intersection of technology and finance. Our team of experts has identified each broker’s strengths and weaknesses using FX Empire’s comprehensive methodology. BA and Honors in Public Diplomacy and Affairs, The Raphael Recanati International School Reichman University DPIJI, Daniel Pearl International Journalism Institute HarvardX. Refine your trading strategy and adjust your entry points, exit points, and position size accordingly. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible. 5 trillion number covers the entire global foreign exchange market, BUT the «spot» market, which is the part of the currency market that’s relevant to most forex traders is smaller at $2 trillion per day. While evaluating stocks, you will usually notice a quoted price down to the last penny. Headline risks can also lead to a significant rise or fall in capital especially when the news occurs when the market is closed. Candlesticks have been used for a longer period than you think. Concerned about cutting winners too soon. It can be difficult to know which one is the best for you. Trading FX on margin is high risk and not suitable for everyone. See Development for discussion. Short term options trading is much different than stock investing.